- Have any questions?

- [email protected]

On the states budget of hypocrisy, PR stunts, and deficits (SEE FIGURES)

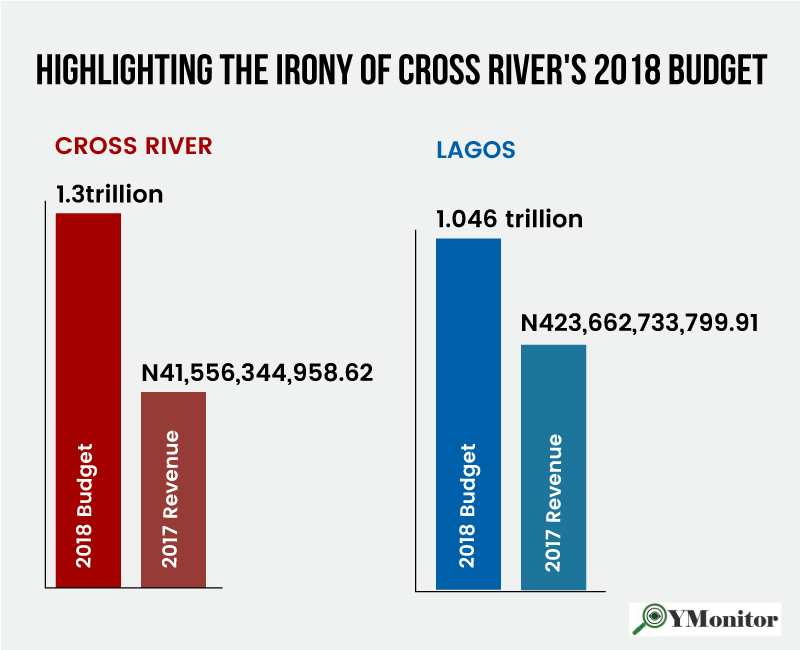

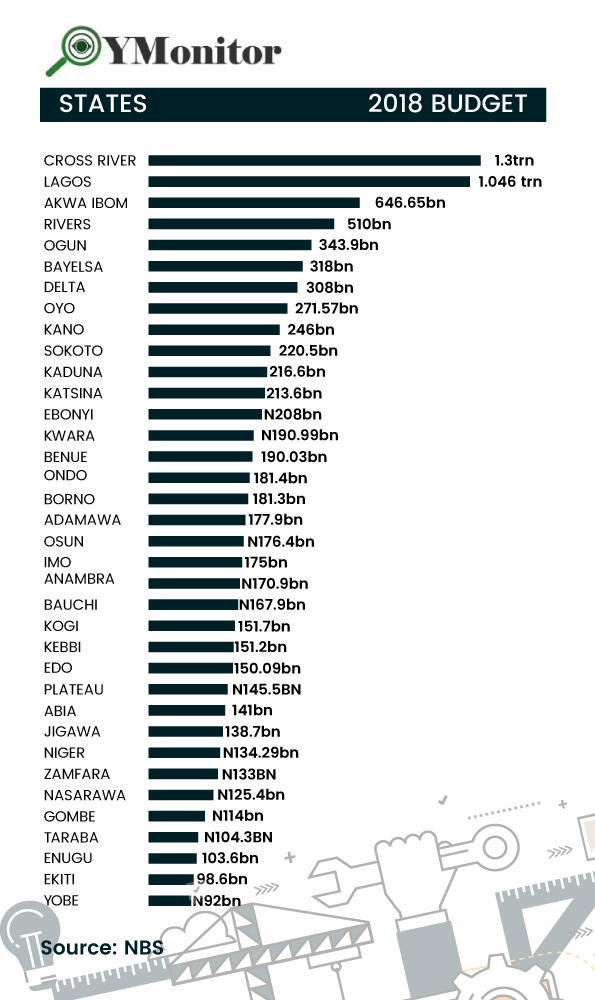

Cross River set to spend more than Lagos in 2018, see list of states budget in 2018

10 April 2018

How does Cross River intend to finance its staggering N1.3trillion budget?

13 April 2018by Usman Alabi

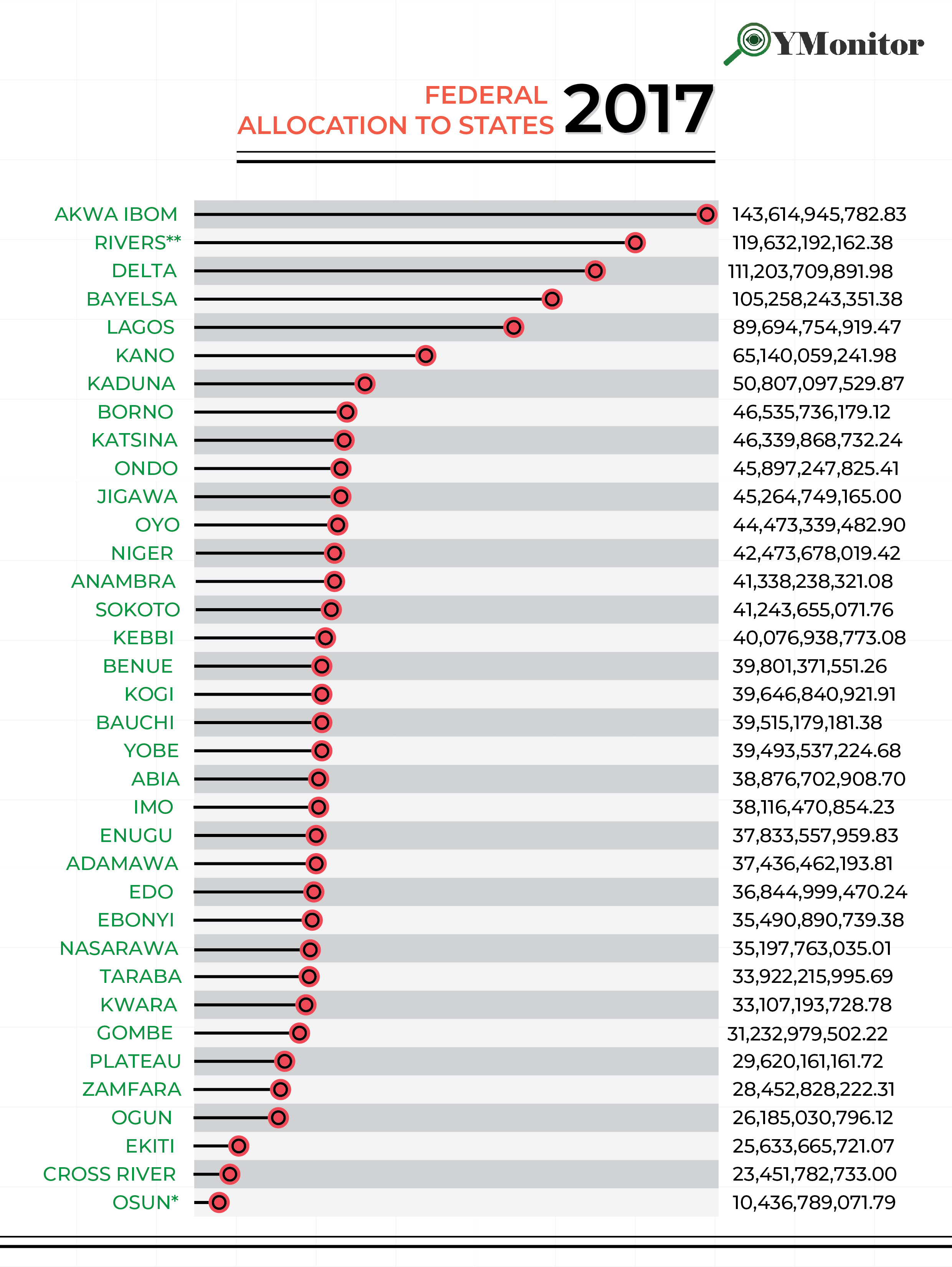

Only few of the 36 states have the financial capacity to effectively implement their 2018 budgets. Budget making in Nigeria has become a ritual and public relation tool by states to hide and deflect attention from a deeper question relating to their viability. Most of the states have a tradition of drawing up humongous budget that they are financially incapable of financing. The total revenue of most of the states in Nigeria is not even enough to finance half of their annual budget, which often result to excessive borrowing.

Ogun state in 2017 has an IGR of N74.84 billion, in 2016, it recorded N72.98bn IGR. In the current year, Ogun state has a budget of N343.9bn. Ogun’s total revenue in 2017 (IGR and FAAC) is N101,021,009,796.63. So how does a state with less than N102 billion revenue intends to finance a budget that is more than twice her revenue. This perhaps explains the state’s foreign and domestic debt which stands at $107,449,174.80 and N106.53 billion respectively. With this, considerable level of budget implementation becomes a myth, most of the projects embarked by these states are either carried over to another year, abandoned halfway or never started at all.

Ogun state for example have been unable to complete the five flyovers around Ifo local government area of the state. The flyovers were started more than four years ago. They are located in Alagbole, Akute, Lambe, Agbado and Ijoko, and even now, work on the project is on a snail pace with no date of completion in sight, there had also been accusation against the state government that most of her activities are only located in Abeokuta, while other parts of the states suffer from paucity of infrastructure.

Lagos started the light rail project 10 years ago, initially it was meant to be completed three years after it was inaugurated, but completion date has been postponed three times, and now the state government has been silent on the project while work snail on.

Sokoto has a total of N220.5bn 2018 budget, and it has only managed N13.564bn IGR between 2016 and 2017. In 2017, Sokoto’s total revenue according to NBS was N50.26bn, with this, one begins to question the veracity of budget implementation in this state which has external and domestic debt portfolio of $41.16milliion and N26.028bn respectively. Practically all the states in Nigeria have deficit budget that will increase their debt burden if at all they are serious about implementation.

Cross River state with a paltry N32.88bn IGR between 2016 and 2017 and a meagre average total revenue of N41.56bn in 2017 currently has the largest budget amongst states in Nigeria, slightly surpassing Lagos, her 2018 budget stands at N1.3trn. Implementing this kind of budget in a state with external and domestic debt of $167,922,477 & N125.648bn respectively in 2017 is nothing but a mirage. This is not only a deficit budget but highly unrealistic. The question is what does the state has to finance such huge budget, especially given the fact that TINAPA is no more a financial goldmine and presently the state government seems to have given up completely on the project.

Anambra state’s budget for 2018 is N170.9bn, her total revenue for 2017 was N58.7bn. In two years, (2016 and 2017), the state only managed an IGR of N32.6bn, a complete deficit budget which the state has no capacity to implement except by increasing her debt burden. Benue’s 2017 budget is also not different from that of the other states in terms of its deficit character. The state’s total revenue for 2017 was N52.2bn, hence one can begin to make projections as to the extent she would be able to implement her N190.03bn 2018 budget, especially in the context of a total IGR of N21.96bn generated in two years (2016 and 2017).

Ekiti with one of the lowest budget in 2018, has a budget of N98.6bn, in 2017, the state’s total revenue was N30.6bn. Ekiti’s IGR in 2017 was N4.97bn which was a slight improvement from the N2.991bn generated in 2016. Ekiti’s domestic and external debt profile in 2017 stand at $78m and N117.495bn respectively, which is bound to increase if the state is serious about implementing her budget.

Borno, one of the three Northeast states whose economy has been severely hampered by insurgency managed to post an IGR of N4.98bn in 2017 and N2.68bn in 2016. Borno’s total revenue in 2017 was N51.52bn. The state’s internal and external debt profile in 2017 stands at $22.59m & N54.042bn respectively, Borno’s 2018 budget is N181.3bn. So also Yobe state which is also plagued by insurgency, posting an IGR OF N3.598bn in 2017, and N3.240bn in 2016. Yobe’s 2018 budget stands at N92bn. In 2017, the state’s total revenue was N34.476bn. The state’s external and domestic debt profile in 2017 is $29.56m & N26.47bn respectively.

Adamawa’s 2018 budget on the other hand is N177.9bn, the state’s total revenue in 2017 was N43.64bn. Her debt profile in 2017 both external and domestic stands at $94.57m & N69.61bn respectively. Adamawa’s IGR in 2017 was N6.2bn and N5.79bn in 2016.

Most of these states cannot survive without federal allocation, their total internally generated revenue is meagre when compared to the amount they receive as allocation, apart from the allocation they receive, most of the states are still been subsidized by the federal government so as to keep the machinery of government going, a lot of them are owing salaries, states like Kogi, Osun and even Ekiti are example of such states. And even after receiving considerable amount in Paris Cub Refund on two occasions, they are still unable to offset their deficit.

Osun state proposed 2018 budget is N176bn, her total revenue in 2017 was N22.17bn, the state’s IGR in 2017 was N11.73bn which was a slight increase from N8.88bn recorded in 2016. Osun’s external and domestic debt in 2017 stands at $96.6m and N138.24bn respectively. And when it comes to infrastructural development, Osun has not fared better especially in areas that are outside the state capital.

Only very few states have the capacity to implement their budget to a considerable extent, most carryover projects in their budget to the next year, while some abandon some items in their budget due to paucity of funds. States like Cross River, Akwa Ibom, Ogun and even Oyo with large budget for the year do not exactly have the capacity to implement their budget. Budget in most states of the federation are nothing but PR fanfare aimed at portraying the government to be working. Already most of the states are highly indebted and their income in the next ten years might not be able to offset these loans.

|

S/N |

State |

2018 BUDGET |

Status |

Total Revenue Available to States in 2017 (FAAC and IGR) source: NBS

|

| 1 | Cross River | 1.3trn | Passed | N41,556,344,958.62 |

| 2 | Lagos | 1.046 trn | Passed | N423,662,733,799.91 |

| 3 | Akwa Ibom | 646.65bn | Passed

|

N159,571,299,818.13 |

| 4 | Rivers | 510bn | Passed | N209,177,175,571.48 |

| 5 | Ogun | 343.9bn | Passed | N101,021,009,796.63 |

| 6 | Bayelsa | 318bn | Passed | N117,782,055,801.97 |

| 7 | Delta | 308bn | Passed | N163,091,715,230.31 |

| 8 | Oyo | 271.57bn | Passed | N66,921,678,307.51 |

| 9 | Kano | 246bn | Passed | N107,558,870,712.62 |

| 10 | Sokoto | 220.5bn | Passed | N50,262,499,379.05 |

| 11 | Kaduna | 216.6bn | Passed | N77,337,660,410.76 |

| 12 | Katsina | 213.6bn | Passed | N52,369,719,590.00 |

| 13 | Ebonyi | N208bn | Yet to be Passed | N40,593,793,106.20 |

| 14 | Kwara | N190.99bn | Passed | N52,745,067,241.00 |

| 15 | Benue | 190.03bn | Passed | N52,200,786,109.05 |

| 16 | Ondo | 181.4bn | Passed | N56,825,119,305.17 |

| 17 | Borno | 181.3bn | Passed | N51,519,067,228.36 |

| 18 | Adamawa | 177.9bn | Passed | N43,637,831,761.04 |

| 19 | Osun | N176.4bn | Yet to be passed | N22,167,815,516.17 |

| 20 | Imo | 175bn | Passed | N44,967,267,720.30 |

| 21 | Anambra | N170.9bn | Passed | N58,703,624,151.59 |

| 22 | Bauchi | N167.9bn | Yet to be passed | N43,884,590,631.65 |

| 23 | Kogi | 151.7bn | Passed | N50,891,101,896.66 |

| 24 | Kebbi | 151.2bn | Passed | N44,470,712,738.47 |

| 25 | Edo | 150.09bn | Passed | N62,187,828,682.46 |

| 26 | Plateau | N145.5BN | Passed | N40,408,444,571.17 |

| 27 | Abia | 141bn | Passed | N53,793,844,714.50 |

| 28 | Jigawa | 138.7bn | Passed | N51,914,950,145.11 |

| 29 | Niger | N134.29bn | Passed | N48,991,617,052.49 |

| 30 | Zamfara | N133BN | Passed | N34,476,823,153.25 |

| 31 | Nasarawa | N125.4bn | Passed | N41,371,899,987.60 |

| 32 | Gombe | N114bn | Passed | N36,505,252,910.50 |

| 33 | Taraba | N104.3BN | Passed | 39,686,467,229.54 |

| 34 | Enugu | 103.6bn | Passed | N59,872,780,862.69 |

| 35 | Ekiti | 98.6bn | Passed | N30,601,165,536.86 |

| 36 | Yobe | N92bn | Passed | N34,476,823,153.25 |